Information on Property Taxes

.png) |

|

|

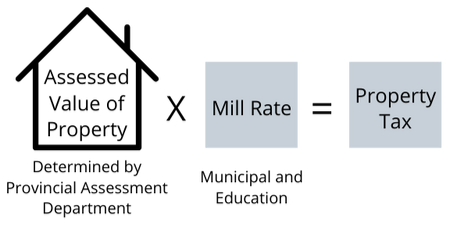

Property taxes are calculated by applying municipal and education mill rates against the portioned assessment of your property.

Your annual tax statement is composed of two sections: municipal and education taxes. For more information on your education taxes, please contact the Seine River School Division at 204-878-4713. The Education Tax Levy is set by the Seine River School Division. The Town of Ste. Anne is required by law to include these levies on the annual property tax bills, and has no control over the school tax portion of your tax bill.

Municipal Taxes

Municipal taxes are funds required to cover the cost of operating the Town and its provided services, and are identified in the annual financial plan (budget). Municipal taxes are set annually, by by-law, following a public hearing. Copies of the approved financial plan are available at the Town of Ste. Anne Office or on our website here.

Municipal levies can include local improvement and general levies. Other municipal charges may also include garbage collection, and sewer usage fee (billed as a quarterly utility bill).

Local Improvement Levy

This levy is applied to properties to pay for the cost of an improvement that was constructed for the benefit of these specific properties. Examples include re-paving a road, or upgrades to a sewer line on a specific street or area.

General Municipal Levy

This levy is applied to all taxable property in the Town for the purpose of providing funds for general operating costs including council and administration.

Special Services Levy

This levy is applied to all properties in the Town for the purpose of providing funds for services, including Fire Protection, Police Services, Roads & Sidewalks Maintenance, Streetlighting, Drainage, Dust Control, Snow Removal Services, Recreational Support Services, By-Law Enforcement Services and Emergency Measures.

Property Tax Bills

Annual property tax statements are printed by the Province of Manitoba, and are typically mailed out in June. the amount of taxes indicated on your statement represents the amount due for the entire fiscal year (January 1st to December 31st).

Property Taxes are due and payable on or before the last business day of July. Any payments received by the Town after 4:30 pm on the date indicated on your property tax statement are subject to penalties. All taxes remaining unpaid subsequent to said date shall be subject to penalties charged at a rate of 1.25% per month commencing the 1st of August, and on the 1st of each month thereafter, until full payment is received.

*Please note that as of January 2025 receipts will no longer be mailed out. If you require a receipt, please contact the Town office to sign up for e-receipts.

Change in Ownership

If a changed in ownership has occurred, please return the property tax bill to our office, or forward to the new owners if possible. Failure to receive a bill does not excuse an owner from the responsibility for payment of taxes or relieve the owner from the liability for any late fee penalties. Our office receives Land Title ownership changes directly from Land Titles and the Manitoba Assessment Office, however, this can take up to 1 or 2 months before we receive the new ownership. All owners must contact our office for new or final utility billing.

Outstanding Balances

If a portion of your previous year's taxes remain outstanding, this amount is listed in the arrears/credits box on your tax statement. This amount is only calculated up to the date the information was processed for printing of the tax statements. Please verify with our office the current balance outstanding if you have arrears.

Homeowners Affordability Tax Credit 2025

The Manitoba Government is replacing the School Tax Rebate and Education Property Tax Credit with the new Homeowners Affordability Tax Credit of up to $1,500 on principal residences. For more information:

- call Manitoba Government Inquiry at 1-866-626-4862 or

- visit manitoba.ca/lowercosts or Province of Manitoba | News Releases | New Tax Credit for Homeowners will Save Manitobans More Money (gov.mb.ca)

This year, residential property owners who qualify can receive a rebate on school taxes for 2025. To qualify, the property must be your primary residence, a single dwelling unit and the only property to receive the credit in Manitoba. For this credit to be applied directly to your property tax notice you must apply to the Town of Ste Anne in person or online HATC application.

TIPPS Program

The Town of Ste. Anne offers the TIPPS program. The Tax Instalment Payment Plan Services, or TIPPS, allows property owners to make twelve monthly payments for taxes rather than a single annual payment in July. Upon application, the Town will arrange for payments to be withdrawn from the property owner's bank account. ** This program does not pay towards current outstanding balances. This is a pay in advance program.

To be eligible to enroll in the plan, one must be the registered owner of a property in the Town of Ste. Anne, the tax account must have no outstanding balance, and must have banking privileges at a Financial Institution (Bank or Credit Union). Applications for the 2025 property taxes are not accepted at this time. All applications received will be enrolled in the 2026 TIPPS payment cycle, starting January 2026.

For an application form to enroll in the plan, click here. Applications can be sent by email to accounts@steanne.ca.

Tax Sale - Properties in Arrears

Properties in arrears of any amount for 2 years or more (referred to as delinquent taxes) will be subject to the Tax Sale process. The Tax Sale process will add additional costs and fees that will greatly increase the amount owing.

All properties listed in the tax sale process are redeemable until the public auction. There will be no redemption period once the tax sale, by public auction, has commenced. All property sales are final at the public auction.

To avoid being subject to the Tax Sale process and the additional fees and costs, ensure to have all property taxes two (2) years or more outstanding paid in full by the last business day in February.